By Kim Kennedy, Director of Forecasting, Dodge Data & Analytics

BEDFORD, MA – May 8, 2020 – Gut-wrenching is the word that comes to mind regarding the U.S. Bureau of Labor Statistics’ latest employment release. In April, the first full month of stay-at-home orders and social distancing due to COVID-19, the U.S. economy lost 20.5 million jobs and the unemployment rate spiked to 14.7%. This was, by far, the largest collapse of the labor market since the Great Depression. March job losses were revised down to 870,000 and, combined with April, sum to 21.4 million job losses over the past two months. These losses dwarf the 8.7 million jobs lost during the Great Recession and essentially wipe out the 22.4 million jobs gained in the decade since it ended.

The suddenness of the downturn was stunning. As recently as February, the job market had been growing for 113 months and the unemployment rate had fallen to a 50-year low of 3.5%. Furthermore, the current unemployment rate does not include the 5.1 million people whose hours were cut or the unknown numbers whose pay was reduced as a result of the pandemic.

The April figures shattered previous historical records. Previously, the largest one-month decline in employment had occurred in September 1945 when 2.0 million jobs were lost. The previous record for the highest unemployment rates (where records only go back to 1948) was 10.8% in November 1982, although estimates suggest that the unemployment rates reached nearly 25% during the Great Depression.

Job declines were widespread across industries in April. Construction lost 975,000 jobs with most of the losses coming from Specialty Trades, which fell by 691,000. But other industries were hit even harder: the greatest losses came from leisure and hospitality where 7.7 million jobs were lost (47% of the total). Most of these jobs came from restaurants and bars, which were down 5.5 million. The retail sector lost 2.1 million jobs, although warehouses/supercenters gained 93,000 jobs as online shopping surged. Education and healthcare lost a combined 2.5 million jobs in April and professional/business services were down 2.1 million. Even government employment was down 980,000 with most losses coming from local governments where 801,000 employees were laid off, mostly due to school closures.

As many states slowly begin to reopen during the month of May, job losses should begin to abate. Still, it will be many more months before the economy, and the job market, return to any sense of normalcy. As Thomas Paine once said, “These are the times that try men’s souls.”

By Richard Branch, Chief Economist Dodge Data & Analytics

BEDFORD, MA – April 30, 2020 – The much anticipated advance release of first-quarter GDP came in at an annualized -4.8%, the largest quarterly decline since the fourth quarter of 2008. This was a little worse than Dodge’s expectation for a 2.5% decline.

Weakness was widespread. Consumer spending dropped 7.6% on an annualized basis, marking the largest quarterly percentage drop since the second quarter of 1980. Within consumer spending, the only category to post growth in the quarter was nondurable goods (aka groceries and other consumables).

Private investment fell back 5.6% (annualized), but the underlying story was mixed. Stark declines were evident in both nonresidential structures and equipment, the business portions of private investment. Residential investment, by contrast, posted an annualized 21% gain in the first three months of the year. Separately, Dodge reported that first-quarter single family starts were the strongest since 2007. Government spending also increased, but by a tepid 0.7% (annualized) in the first quarter.

Of course, the first quarter ended with March, before the full force of shutdowns, increased unemployment, and physical distancing were fully accounted for in economic data. Second-quarter GDP will likely be even more dour — dropping by 24% on an annualized basis in the Dodge forecast. And this may turn out to be an overly optimistic projection.

As the year transitions into the second half and as the country gradually reopens, the economy will rebound. However, the growth trajectory will depend largely on the track of the virus and how well it can be contained as stay-at-home orders are eased. Tracking, measuring, and very gradual re-opening will be key to a sustained recovery.

By Richard Branch, Chief Economist, Dodge Data & Analytics

BEDFORD, MA – FEBRUARY 24, 2020 – The mounting number of cases of COVID-19 (Coronavirus) has roiled stock markets around the world and added concern that global economies will be materially impacted. Estimates from Moody’s Analytics suggest that first-quarter U.S. GDP growth could be reduced by nearly 0.45 percentage points as a result of the outbreak with tourism and travel taking the largest hit among U.S. industries. If the outbreak is contained quickly, U.S. economic growth should rebound in the second quarter.

The most notable impact comes from supply chains for goods from China. These supply chains have been crimped as Chinese workers remain at home, causing production to fall substantially. Here in the U.S., General Motors unions have warned that U.S. production could slow as parts dry up. Apple Inc. announced that it will not meet its first-quarter revenue projections as their China plants are shuttered. Even N.H.L hockey players have noted the shrinking supply of hockey sticks. Consumer sentiment is also taking a hit. Should containment of the virus be elusive, we could see consumer spending and business investment sour — which could cause a further drag on U.S. economic growth.

The construction industry is also not immune to challenges presented by the outbreak. A rough calculation suggests that nearly 30% of products typically used in U.S. building construction are imports from China, making the country the largest single supplier to the U.S. If the virus is not quickly contained and quarantines remain intact, supplies will continue to tighten causing building costs to continue to escalate, and potentially causing projects to be delayed or cancelled outright. The exact extent to which this happens will depend on the ability of U.S. builders to substitute products from China to domestic or other international suppliers. Note though, that many Asian countries, such as Japan, South Korea, and Vietnam that also export building products to the U.S. rely heavily on raw materials from China.

At present, our outlook continues to expect a modest decline in construction starts in 2020. The current outbreak is one of many issues facing the U.S. economy this year that will lead to a slowdown in overall economic growth and push starts lower. The issue, however, remains in flux. Dodge will continue to assess the impact of the COVID-19 virus in the coming months.

By Richard Branch, Chief Economist

BEDFORD, MA – January 30, 2020 – The advance reading for U.S. Gross Domestic Product in the fourth quarter came in at a close-to-expected annualized 2.1%. While likely to be revised in the coming months, it painted a picture of an economy that continues to hover near its potential rate.

A closer look at the details, however, suggests that there are reasons to expect slower growth in 2020. On the plus side, the fourth quarter pace of government spending picked up driven equally by state and local governments and federal defense spending. Trade also provided a sizeable positive contribution to the headline number as exports jumped and imports tumbled.

Total fixed investment was neutral in the fourth quarter. As expected, residential investment picked up in line with rising sales and construction of single family housing in the fourth quarter. However, nonresidential investment in both equipment and structures declined for the third consecutive quarter most likely due to uncertainty over trade policy. Inventories were also a net drag on headline GDP.

The consumer, who has been the stalwart of economic growth through most of 2019, took a concerning breather, however, as spending growth cooled from an annualized 4.6% in the second quarter and 3.1% in the third quarter to just 1.8% in the final three months of the year.

For the full year, the U.S. economy grew at a 2.3% pace, down from the 2.9% rate in 2018, but about on par with growth in 2017.

Looking ahead, labor constraints are likely to slow employment growth in 2020 making it harder for consumers to sustain their level of contribution to the economic growth. Business investment is also likely to remain sluggish as uncertainty over trade policy continues despite the Phase I trade deal signed between the U.S. and China in early-January. Residential construction will also struggle to gain a foothold as margins to build entry level homes for the ballooning millennial generation remain tight. All told, economic growth will slow but remain positive in 2020, allowing the longest expansion in U.S. history to continue.

By Richard Branch, Chief Economist, Dodge Data & Analytics

BEDFORD, MA – September 19, 2019 – As widely expected, the Federal Reserve’s Open Market Committee (FOMC) lowered its federal funds rate range by 25 basis points (bps) to 1.75% – 2.0%. This marks the second rate cut of the year. What was less certain about the Fed’s move, however, was how they would portray current risks to the economy and what that implied for further changes to the federal funds rate.

In the accompanying press release, the Fed noted that consumer spending “has been rising at a strong pace” due to underlying strength in the labor market. This phrasing was slightly more upbeat than in July’s release when they also cut rates. However, they also noted “business fixed investment and exports have been weakening”, a more ominous tone than in July and a nod to potential risks to the economy caused by trade tensions with China. Overall, the Fed remained upbeat and raised their 2019 GDP forecast from 2.1% to 2.2%, with economic growth pegged at 2.0% in 2020, unchanged from their previous forecast.

The “dot plot”, which shows individual committee members’ expectations of the future path of the federal funds rate, also shifted slightly. The median path of the plot now suggests that the rate will remain in its present range through the end of the year, after the 50 bps of easing that occurred between July and September. Interestingly, it also suggests no further cuts in 2020, before rates move higher in 2021. Three committee members dissented in this month’s vote (one more than in July). Two voted against any rate cut and one voted in favor of a 50 bps cut.

Yesterday’s cut was largely priced in by the markets so there should be only minimal effects on bond markets and short-term interest rates. The FOMC has two more meetings in 2019 – in October and December. Dodge Data & Analytics continues to expect one more rate cut this year, with the potential for an additional cut in 2020 in anticipation of much slower economic growth by yearend.

By Kim Kennedy, Director of Forecasting

Payroll employment grew by 164,000 in July, following a downwardly revised increase of 193,000 in June. This month’s increase indicates that employment and the overall economy continue to grow even if the pace has slowed from last year and even though the economy has now been expanding for a decade. After increasing at a monthly rate of 223,000 in all of 2018, job growth slowed to 165,000 per month in the first seven months of 2019 and slowed further to just 140,000 in the most recent three months. Despite the slowing pace of growth, the unemployment rate remained steady at 3.7% in July. Even July’s wage growth, which has been particularly soft over the long stretch of the recovery, rose by a healthy 3.2% from a year earlier.

July’s employment growth was broad-based, with many industries showing gains. The service-producing sector dominated July gains with an increase of 133,000 jobs. Goods-producing industries gained just 15,000 and government grew by 16,000. Within services, the large education and healthcare sector advanced by a strong 66,000 jobs and professional/business services rose by 38,000.

Within the goods-producing sector, manufacturing gained 16,000 jobs as the motor vehicle and parts industry saw employment grow by a healthy 7,200 after a modest dip in June. At the same time, construction was only able to add 4,000 jobs in July after a more ambitious 18,000 gain in June. Within construction, the improvement came from specialty trades contractors, where employment rose by 7,400. Employment in residential building gained 1,400 and nonresidential building remained little changed, but heavy/civil engineering construction fell by 4,300 jobs.

The consensus believes this was a solid jobs report, signaling that the economy still has life left in it, but within the report were suggestions that the economy is slowing over and above the general slowdown in job growth. The average workweek declined (manufacturing has cut back overtime) and total hours have flattened in 2019. These cautionary indicators may be behind the Federal Reserve’s move to drop interest rates by a quarter percent earlier this week. The Fed cited a slowing global economy and a desire to shore up domestic growth as its reasons for the dip in interest rates. Uncertainty about trade policy is also giving the Fed cause for concern. In fact, Wall Street expects the Fed to continue lowering rates at its next meeting in September. While most don’t expect this jobs report to have much effect on the Fed’s rate decision, the administration’s decision to increase tariffs on Chinese imports may be more impactful.

Nonbuilding Construction and Nonresidential Building Rebound After a Weak April

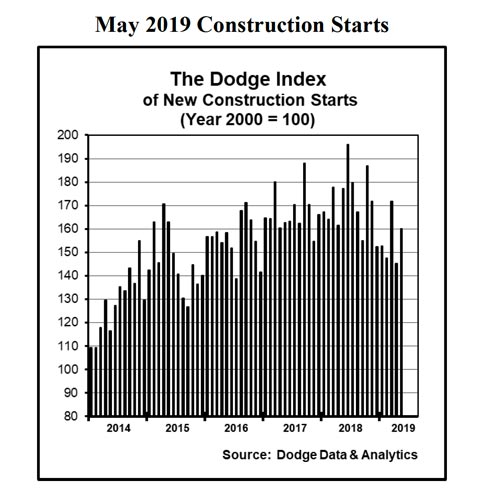

NEW YORK – June 20, 2019 – At a seasonally adjusted annual rate of $757.0 billion, new construction starts in May climbed 10% from April, according to Dodge Data & Analytics. The increase continues the double-digit swings that were reported during the previous two months, when a 16% hike for total construction starts in March was followed by a 15% decline in April. Each of the three main construction sectors contributed to May’s 10% gain. Nonbuilding construction rebounded 32% after depressed activity in April, lifted by an especially strong amount of new power plant starts and an $800 million light rail project in the Minneapolis MN area. Nonresidential building improved 7%, supported by groundbreaking for two very large manufacturing plant projects. Residential building edged up 2%, with modest gains for both single family housing and multifamily housing. Through the first five months of 2019, total construction starts on an unadjusted basis were $295.0 billion, down 9% from the same period a year ago. On a twelve-month moving total basis, total construction starts for the twelve months ending May 2019 were 2% below the amount reported for the twelve months ending May 2018.

The May statistics raised the Dodge Index to 160 (2000=100), up from April’s 145. May’s reading was still less than the 172 reported in March, as well as the full year 2018 average for the Dodge Index at 171.

“The presence of very large projects frequently causes volatility in the month-to-month pattern of construction starts, and that’s certainly been the case during March, April, and now May,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “Amidst the volatility, the pace of construction starts has on balance been sluggish so far in 2019, as activity has been generally lower than the healthy volume witnessed during the first half of last year. For public works, there was some dampening in early 2019 arising from the partial government shutdown, although highway and bridge construction has shown improvement in recent months. For nonresidential building, the boost coming from very large projects so far this year has not been of the same magnitude as what took place last year. For residential building, multifamily housing has pulled back from last year’s strength, while single family housing has been essentially flat. At the same time, there are still positive factors in the current environment affecting construction. Federal appropriations for fiscal 2019 are in place, and funding support is coming from the state and local bond measures passed in recent years. Market fundamentals for commercial building and multifamily housing strengthened during 2018 and early 2019, while interest rates remain low. As 2019 proceeds, it’s expected that the shortfall between this year’s level of construction starts compared to last year will narrow.”

Nonbuilding construction in May was $194.4 billion (annual rate), a 32% increase that followed a 33% slide in April. The electric utility/gas plant category surged 552% in May, bouncing back from a very weak April to a volume more than twice the average monthly pace during 2018. This reflected the start of five power plant projects valued each at $200 million or more – a $550 million natural gas-fired power plant in Ohio, the $450 million Emmons-Logan Wind Energy Center in North Dakota, the $300 million Ida Grove Wind Farm in Iowa, the $200 million Southern Oak Solar Energy Center in Georgia, and a $200 million electric substation upgrade in Wyoming. The public works categories as a group slipped 1% in May, due to a mixed performance by the individual project types. The miscellaneous public works category, which includes such diverse segments as site work, rail transit, and pipelines, increased 20% as the $800 million Metro Green Line Southwest light rail transit in Minnetonka MN was included as a May start. Water supply construction rose 23% in May, helped by such projects as the $92 million Oak Ridge Outfall Treatment Facility in Oak Ridge TN and an $87 million water reclamation plant upgrade in Valencia CA. On the negative side, highway and bridge construction eased back 2% in May following 8% improvement over the previous two months. The top five states in terms of the dollar amount of highway and bridge construction starts in May were -– California, Texas, Illinois, New York, and Florida. The river/harbor development category dropped 22% in May, while sewer construction retreated 24% even with the start of a $118 million wastewater pumping station upgrade in Honolulu HI.

Nonresidential building in May was $266.6 billion (annual rate), up 7% following a 16% drop in April. The manufacturing plant category provided much of the lift, soaring 350% as two very large manufacturing plant projects were included as May construction starts – the $1.6 billion Shintech polyvinyl chloride manufacturing facility in Plaquemine LA and a $600 million steel mill expansion in Osceola AR. The commercial categories as a group receded 5% in May, the result of a slower pace for office construction, down 17%; and commercial garages, down 26%. Even with the decline, office construction in May did include the start of several noteworthy projects, such as the $263 million George H.W. Bush office building in Austin TX, a $258 million office tower in Nashville TN, and a $250 million office/research development building in South San Francisco CA. Two large data center projects also reached groundbreaking in May – a $150 million Microsoft data center in Goodyear AZ and the $135 million Raging Wire data center in Ashburn VA. On the plus side, warehouse construction in May jumped 39%, helped by groundbreaking for a $182 million distribution center in the Bronx NY and the $155 million TJX Home Goods distribution center in Lordstown OH. Hotel construction in May grew 9%, featuring the start of the $305 million hotel portion of the $700 million Philadelphia Live Casino and Hotel in Philadelphia PA. Store construction, while remaining at a subdued volume, grew 4% in May.

The institutional building categories as a group settled back 2% in May. Educational facilities, the largest nonresidential building category by dollar volume, slipped 1% in May, although the latest month did include groundbreaking for the $205 million Wellesley College science center renovation in Wellesley MA and a $150 million museum renovation at the University of Michigan in Ann Arbor MI. The public buildings category (courthouses and detention facilities) dropped 3% in May, and transportation terminal work fell 63% from April that included the start of the $972 million terminal building portion of the $1.3 billion new airport terminal project at Kansas City International Airport. At the same time, healthcare facilities strengthened 27% in May, reflecting the start of the $500 million MetroHealth Hospital facility in Cleveland OH, the $331 million University of Texas Southwest Medical Center Brain and Cancer Center building in Dallas TX, and a $182 million hospital tower in Turnersville NJ. Amusement-related work jumped 54% in May, led by the $237 million casino portion of the Philadelphia Live Casino and Hotel project. The religious building category, while still remaining at a weak volume, increased 19% in May.

Residential building in May was $295.9 billion (annual rate), a 2% gain that marked the first increase after three straight months of decline. Single family housing improved 2%, showing some growth after the sluggish performance reported earlier in 2019. By geography, single family housing registered this pattern during May – the South Atlantic, up 4%; the Midwest, up 2%; the Northeast, up 1%; and the South Central and West, each unchanged from the previous month. The pace for single family housing in May was still 7% below the average monthly pace during 2018. Multifamily housing in May also grew 2%, edging up for the second month in a row after a 12% decline back in March. There were eight multifamily projects valued each at $100 million or more that reached groundbreaking in May, led by the $653 million multifamily portion of the $850 million One Chicago Square Apartment Towers in Chicago IL, the $266 million multifamily portion of the $360 million Four Seasons mixed-use hotel/condominium project in Nashville TN, and a $160 million multifamily high-rise in Jersey City NJ. The top five metropolitan areas in May, ranked by the dollar amount of multifamily starts that reached groundbreaking, were – New York NY, Chicago IL, Nashville TN, Washington DC, and San Francisco CA. The pace for multifamily housing in May was still 17% below the average monthly pace during 2018.

The 9% decline for total construction starts on an unadjusted basis during the first five months of 2018 was the result of decreased activity for each of the three main sectors. Nonresidential building settled back 3% year-to-date, with 8% declines for both institutional building and manufacturing building that were partially offset by a 3% gain for commercial building. Nonbuilding construction dropped 11% year-to-date, as a 24% plunge for public works was countered by a 128% jump by electric utilities/gas plants. The miscellaneous public works category plummeted 54% year-to-date given the comparison to a strong first five months of 2018 that included several large pipeline projects. If the miscellaneous public works category is excluded, public works during the first five months of 2019 would be down a more moderate 7%. Residential building year-to-date dropped 12%, with single family housing down 9% and multifamily housing down 19%. By geography, total construction starts during the January-May period of 2019 showed this behavior compared to last year – the South Central, down 1%; the Northeast, down 5%; the Midwest, down 8%; the South Atlantic, down 12%; and the West, down 15%.

Additional insight is made possible by looking at twelve-month moving totals, in this case the twelve months ending May 2019 versus the twelve months ending May 2018. On this basis, total construction starts were down 2% from the previous period. By major sector, nonresidential building increased 4%, with manufacturing building up 21%, commercial building up 8%, and institutional building down 3%. Residential building dropped 2%, with single family housing down 2% and multifamily housing down 1%. Nonbuilding construction fell 10%, with public works down 14% while electric utilities/gas plants increased 16%.

By Kim Kennedy, Director of Forecasting, Dodge Data & Analytics

BEDFORD, MA – May 3, 2019 – The job market seems to have bounced back in April after having experienced a mild case of the flu in February and only partial recovery in March. The number of payroll jobs grew by 263,000 in April after gaining just 56,000 in February and 189,000 in March. With this stronger gain in employment, the April unemployment rate slid to 3.6%, the lowest level in 50 years. Given its advanced age (the job market is now in its 10th year of expansion), the health of the labor market continues to surprise.

The heart of this month’s growth came from professional/business services (up by 76,000 jobs), healthcare (up 53,000), and hospitality (up 34,000). Construction payrolls also boosted job growth by a robust 33,000 in April. At the other extreme, the retail sector lost 12,000 jobs in April, continuing its downward slide.

The survey of households showed somewhat more fragility in the labor market than the establishment/payroll survey (reported above). According to this survey, the three main components – the number of people in the labor force, the number of people with jobs, and the number of unemployed people) all declined in April. The total labor force (a combination of those employed and those looking for work or unemployed) fell by 490,000 in April. The number of people employed fell by 103,000 April and the number of unemployed fell by 387,000 over the month. Because the number of unemployed fell by more than the number of employed, the unemployment rate was able to improve.

With a decline in the labor force during April, the labor force participation rate (the share of the 16+ population either employed or looking for a job) slipped to 62.8% – the same as a year earlier, but down from 63.0% in March and 63.2% in the first two months of the year. On the positive side, the participation rate remains above the low of 62.4% reached in September 2015.

The gains in average hourly earnings have also slowed in 2019 despite the very low unemployment rate and tightening labor market. In April, earnings rose 0.2% following increases of just 0.1% in March and January. Only February’s 0.4% gain matched levels seen near the end of 2018. Still, in the first four months of 2019, private sector wages were up 3.3% from a year earlier, much stronger than seen in prior years of the recovery. Construction wages have performed about average in 2019. Although April wages gained a stronger 0.4% over the month, construction wages were up 3.2% in the first four months of the year.

Overall, the April jobs report contained good news for the U.S. economy. It suggests that the first quarter’s ills were perhaps temporary, rather than a sign that the job market, and the entire U.S. economy, have reached the end of their lifecycle as recession nears. Even though it’s no longer a bounding pup, there may be some life in the old dog yet.

By Robert Murray, Chief Economist, Dodge Data & Analytics

BEDFORD, MA – April 26, 2019 – The U.S. economy grew at a surprisingly strong 3.2% in this year’s first quarter, according to the initial estimate from the Bureau of Economic Analysis. Last year had seen deceleration in the rate of GDP growth, sliding from 4.2% in the second quarter to 2.2% in the fourth quarter, and for various reasons it was believed that growth for this year’s first quarter would continue that decelerating trend. These reasons included the partial government shutdown, harsh winter weather, and the waning benefits from the 2018 tax cuts.

The first quarter GDP reading was boosted by several factors. Inventory investment by firms contributed 0.7% to the top-line GDP gain, compared to just 0.1% in the fourth quarter. Exports in the first quarter advanced 3.7%, while imports (for which increases count as a subtraction to GDP) fell 3.7%. And, state and local government spending registered a 3.9% hike in the first quarter, which was its strongest quarterly increase in the past three years.

At the same time, the first quarter GDP report included some cautionary points, even with the strong top-line number. Consumer spending, the largest GDP component, grew just 1.2% in the first quarter, compared to a 2.6% gain for all of 2018. Nonresidential fixed investment rose just 2.7% in the first quarter, compared to a 6.9% gain for all of 2018. The nonresidential fixed investment reading in the first quarter was pulled down by a 0.8% drop for nonresidential fixed investment in structures, which marked the third straight quarterly decline for this series. In addition, residential fixed investment in the first quarter dropped 2.8%, representing its fifth straight quarterly decline, as the recent lackluster performance by single family housing continues to restrain overall economic growth.

On balance, despite the healthy 3.2% gain in the first quarter, the most recent GDP report remains consistent with the sense that the U.S. economy is decelerating from the 2.9% rate of growth reported for 2018 as a whole. The first quarter lift coming from firms building up inventories is not likely to be repeated, and the same holds true for the lift coming from net exports as well as state and local government spending. Furthermore, the subdued readings for nonresidential fixed investment in structures and residential fixed investment are consistent with the picture of a construction expansion that at the very least is now in the process of leveling off.

By Donna Laquidara-Carr, Ph.D., LEED AP, Industry Insights Research Director

BEDFORD, MA – April 23, 2019 – Since 2017, the USG+US Chamber of Commerce Commercial Construction Index has revealed that the biggest challenge facing contractors today is the shortage of skilled workers. One of the most direct ways to tackle this challenge is to be able to draw more people to the industry. The research conducted by Dodge Data & Analytics for the Index in Q1 2019 featured construction careers as a spotlight topic, which helps provide a better understanding of the advantages of a career in construction and how those are typically misunderstood, the aspects of a construction career that may be most appealing to people under 30 and the challenges faced by a fragmented industry in recruiting its workers.

Skilled Worker Shortages and Their Impacts

Consistently, since Q1 2017, over half of the general and specialty trade contractors who participate in the quarterly Commercial Construction Index survey state that they have a high level of difficulty finding skilled workers, and less than 10% report low to no difficulty. The consequences of these challenges are increasingly evident, with 70% of contractors in Q1 reporting that, due to this issue, they are challenged to meet schedule requirements, 63% reporting that they put in higher bids for projects and 40% turning down work opportunities.

Construction Careers: Myth and Reality

Part of the challenge with drawing people into the construction industry appears to be the public misperceptions of it compared to the reality of working in this field. Contractors participating in the survey were asked to select the top three reasons they find construction to be a good career choice and the top three myths about working in this industry.

The most widely selected reason for working in construction is the earning potential, chosen by 70% of respondents. However, one of the top myths about construction as a career, according to 40% of respondents, is that you can’t support a family on construction pay. In addition, over half (56%) of contractors believe that one of the top ways to recruit more workers is, in fact, to develop a better reputation for this industry for high pay. The myth of low pay is clearly a deterrent to drawing more people into construction, and one that needs to be debunked.

Many contractors also report that some of the top myths about construction are that it is a dirty job (selected in the top three by 61%), that it requires brute strength, not training (55%), and that it is just a job and not a real career (52%). However, these are again upended by the experience of contractors themselves. The second highest percentage (43%) regard the opportunities for career advancement as one of the top reasons that construction is a good career, and around one third also note the ability to gain skills on the job (37%) and diversity of work experiences (27%) as top aspects of their work. All of these demonstrate that for practitioners in the industry, construction is a rewarding career with satisfying, challenging work, a message that doesn’t seem to be heard by the public.

Recruiting Workers Under 30

Contractors were also asked about the top ways to attract more workers under 30 to the industry. Not surprisingly, high pay was selected by the highest percentage, and good benefits followed close behind. The next two means of attracting younger workers are related to construction as a career not a job (clear path for advancement) and the work itself (satisfaction derived from a career that involves making something). Again, the most important element appears to be upending the long-standing myths about working in construction to draw younger workers.

Means of Recruiting New Workers

One structural challenge facing the construction industry in its goal to attract new workers is the fragmented ways in which they are recruited. Unlike the other questions in this spotlight survey, contractors were asked to identify all means for recruiting workers, not just the top three. However, no single recruitment strategy, not even placing traditional advertisements for workers, was selected by even half of the contractors surveyed. With no standard ways to find workers, it is not surprising that the positive message about construction careers can become diluted. This is a challenge that few small or midsize contracting companies are in a position to tackle effectively, and it may need to be addressed by larger institutions within the industry in order to address the growing crisis of skilled worker shortages in construction.

Boost your spec rate.

Bid better. Win more.

Link to Dodge. Nourish your business.

IMPORTANT INDUSTRY UPDATE: The potential Impact of Coronavirus (COVID-19) on Construction Starts.Watch the webinar replay.