Report Overview

The global satellite communication market size was valued at USD 62.19 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2020 to 2027. The escalating demand for small satellites for earth observation services in various industries such as oil and gas, energy, agriculture, and defense across the globe is the primary factor driving market growth. Satellite communication refers to transmitting signals in the form of a beam of modulated waves between the sender and receiver antenna with the help of a satellite. These signals are amplified and sent back to the receiver antenna on the earth’s surface. Satellite Communication (SATCOM) also plays a crucial role in increasing the communication technology infrastructure in rural areas. At present, several thousand artificial satellites are orbiting the earth. These artificial satellites transfer analog and digital signals carrying data in the form of voices, photographs, and videos to and from one or several locations across the globe.

Besides, the increase in small satellites, the launch of reusable rocket vehicles, and low-Earth orbit (LEO) are a few key developments in both the military and commercial satellite communication industry. Military satellite communication is becoming increasingly crucial for conducting military operations worldwide. With the combination of commercial communications satellites and military frequency bands, the military SATCOM providers are improving satellite communications capabilities such as personal communication service, global broadcast service, and bandwidth frequency, to meet the military operations requirements in the coming years.

Satellite communication is increasingly being used by the companies to collect operational data to improve efficiency and to realize sustainable ways of conducting business. The companies whose business operations extend to geographically remote locations rely heavily on satellite communications to facilitate real-time asset monitoring and facility monitoring at offshore platforms and unmanned sites. Moreover, as several business facilities are highly remote, deploying terrestrial networks cloud becomes a costly affair. Therefore, these businesses opt for satellite/ mobile satellite services.

Furthermore, the increasing applications and adoption of Artificial Intelligence (AI) and the Internet of Things (IoT) have paved the way for Intelligent Transport Systems (ITS). These systems allow users to track vehicles and enables freight operators to share and receive information promptly. Using satellite communication for transportation will enable seamless and continuous transmission of data between the vehicle and the transport hub, filling the gaps of the terrestrial networks. Therefore, the use of satellites for communications in the transport networks, including logistics, will offer ample growth opportunities for the satellite communication market.

Component Insights

The SATCOM equipment segment accounted for more than 40% share of the global revenue in 2019. Also, the equipment segment is forecasted to expand at the highest CAGR over the forecast period. The segment is further divided into SATCOM transmitter/transponder, antenna, transceiver, receiver, modem/router, and others. The growth of the equipment segment is attributed to factors such as increasing need for uninterrupted communication in numerous industries, including oil and gas, energy and utilities, agriculture, defense, and growing fleet of connected and autonomous vehicles across the globe.

The SATCOM equipment is extensively used in various applications, including military surveillance, weather monitoring, navigation, and telecommunications. Also, SATCOM equipment is used to collect real-time data during wars, locate undetected tunnels, integrate targets, and trace movements, among other uses. Further, the growing requirement for high throughput satellite services and the increasing adoption of cloud-based services for ground mobility platforms are other factors supporting the growth of the segment.

Application Insights

The broadcasting segment dominated the satellite communication market and accounted for more than 42% of the revenue share in 2019. The segment is expected to continue its dominance over the forecast period. The application segment is further divided into voice services, data services, and broadcasting services. Broadcasting services include television and radio directly delivered to the consumer as well as mobile broadcasting services. Benefits of satellite TV, a form of pay-TV, and radio, including seamless connectivity in the far-off areas or locations has been the primary factor for the growth of the segment in the market. However, the prevalence of over-the-top (OTT) services has been observed to hinder the growth of the market.

The penetration of the internet has been increasing over the years across the globe. Additionally, the demand for content delivered over the internet has witnessed a significant increase over the years, primarily due to the growing use of OTT services, especially by gen-x. Moreover, satellite communication is used to transfer data collected through navigational and observational satellites in industries such as agriculture and public safety, among others. As a result, the data communication segment is anticipated to witness high growth in the coming years.

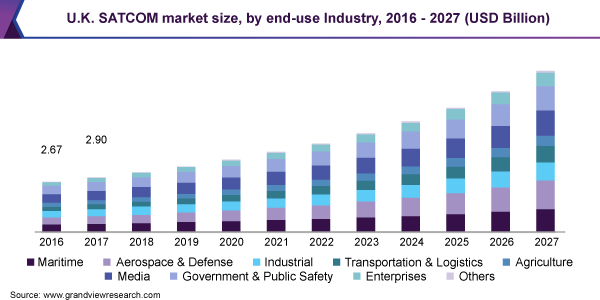

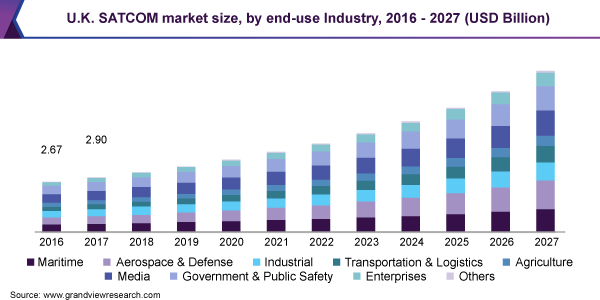

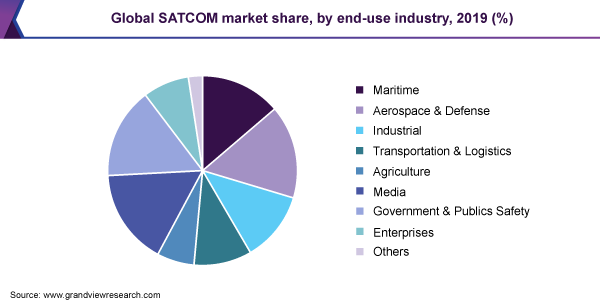

End-use Industry Insights

The media segment led the satellite communication market and accounted for over 16.4% of the revenue share in 2019. This growth is primarily attributed to the high use of satellites for broadcasting as satellites provide seamless remote coverage. Additionally, under the end-use industry, the market has been segmented into maritime, aerospace and defense, industrial, transportation and logistics, agriculture, media, government and public safety, enterprises, and others. The industrial segment is further segmented into oil and gas, mining, energy and utilities, and other industries. The aerospace and defense segment is anticipated to witness the highest CAGR over the forecast period.

Satellite communication services are increasingly being used by the military and defense forces to establish or increase connectivity across various assets of the forces such as fighter planes. Moreover, the growing market for unmanned aircraft systems and their increasing non-military applications has propelled the growth of satellite communication systems. Beyond the Line of Sight (BLOS), operations require satellite connectivity to establish a connection between the aircraft and the ground-based pilot for retrieving images and data collected by the onboard systems. The growing applications and requirements for continuous and uninterrupted communication in the aerospace & defense segment are expected to bolster the market growth.

Regional Insights

The North American region dominated the SATCOM market and accounted for over 32.0% of the revenue share in 2019. The growth is attributed to the rising demand for continuous communication by the defense industry and increased demand for SATCOM equipment by the US defense department. Also, the presence of a large number of SATCOM providers such as Viasat, Inc.; Telesat; and EchoStar Corporation, is contributing to market growth. Moreover, the North America regional market is expected to expand at a considerable CAGR in the forthcoming years, owing to the reinforcement of military communication infrastructure.

The Asia Pacific region is expected to witness the highest CAGR over the forecast period. Countries such as China and Japan are the major contributors to the higher share and growth of this region. The growth can be attributed to the increasing use of satellite antenna in telecommunication, IT, and aerospace and automobile industries. Besides, Europe is expected to witness the second-fastest growth in the forthcoming years owing to the modernization of infrastructure and increasing passenger traffic in marine and coastal tourism.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of several market players. These players are striving to gain a higher market share by adopting various strategies. The satellite operators are also spending huge amounts on developing applications over the Ka-band frequency bands, that will facilitate the transfer of crucial information and high transmissions speed with the use of small ground equipment. Moreover, they are also focusing on maintaining competitive pricing. Additionally, the market players are engaging in partnerships and acquisitions and mergers. For instance, in September 2019, SES SA and Dataset, which provides gateway internet services, entered into a partnership agreement that aimed at providing end-to-end connectivity in the Mediterranean Sea thereby servicing cargo and passengers across destinations including Italy, Spain, Greece, and Morocco. Some of the prominent players in the satellite communication market include:

-

SES S.A

-

Viasat, Inc.

-

Intelsat

-

Telesat

-

EchoStar Corporation

-

L3 Technologies, Inc.

-

Thuraya Telecommunications Company

-

SKY Perfect JSAT Group

-

GILAT SATELLITE NETWORKS

-

Cobham Limited

Satellite Communication Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2020 |

USD 62.63 billion |

|

Revenue forecast in 2027 |

USD 122.98 billion |

|

Growth Rate |

CAGR of 9.2% from 2020 to 2027 |

|

Base year for estimation |

2019 |

|

Historical data |

2016 – 2018 |

|

Forecast period |

2020 – 2027 |

|

Quantitative units |

Revenue in USD million and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Component, application, end-use industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; South Korea; Brazil; Mexico |

|

Key companies profiled |

SES S.A; Viasat, Inc.; Intelsat; Telesat; EchoStar Corporation; L3 Technologies, Inc.; Thuraya Telecommunications Company; SKY Perfect JSAT Group; GILAT SATELLITE NETWORKS; Cobham Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global satellite communication market report on the basis of component, application, end-use industry, and region:

-

Component Outlook (Revenue, USD Million, 2016 – 2027)

-

Equipment

-

SATCOM Transmitter/Transponder

-

SATCOM Antenna

-

SATCOM Transceiver

-

SATCOM Receiver

-

SATCOM Modem/Router

-

Others

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2016 – 2027)

-

Voice Communication

-

Broadcasting

-

Data Communication

-

-

End-use Industry Outlook (Revenue, USD Million, 2016 – 2027)

-

Maritime

-

Aerospace & Defense

-

Industrial

-

Oil & Gas

-

Mining

-

Energy & Utilities

-

Others

-

-

Transportation & Logistics

-

Agriculture

-

Media

-

Government & Public Safety

-

Enterprises

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 – 2027)

-

North America

-

The U.S.

- Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East & Africa

-

Frequently Asked Questions About This Report

How big is the satellite communication market?

b. The global satellite communication market size was estimated at USD 62.2 billion in 2019 and is expected to reach USD 66.6 billion in 2020.

What is the satellite communication market growth?

b. The global satellite communication market is expected to grow at a compound annual growth rate of 9.2% from 2020 to 2027 to reach USD 122.98 billion by 2027.

Which segment accounted for the largest satellite communication market share?

b. North America dominated the satellite communication market with a share of 35.8% in 2019. This is attributable to the growing demand for continuous communication by the defense industry and increased demand for SATCOM equipment by the U.S. defense department.

Who are the key players in the satellite communication market?

b. Some key players operating in the satellite communication market include SES S.A.; Viasat, Inc.; Intelsat; Telesat; EchoStar Corporation; L3 Technologies, Inc.; Thuraya Telecommunications Company; SKY Perfect JSAT Group; GILAT SATELLITE NETWORKS; Cobham Limited.

What are the factors driving the satellite communication market?

b. Key factors that are driving the market growth include the escalating demand for small satellites for earth observation services in various industries such as oil & gas, energy, agriculture, and defense and increasing use of satellite communications by the companies to collect operational data to improve efficiency and to realize sustainable ways of conducting business.